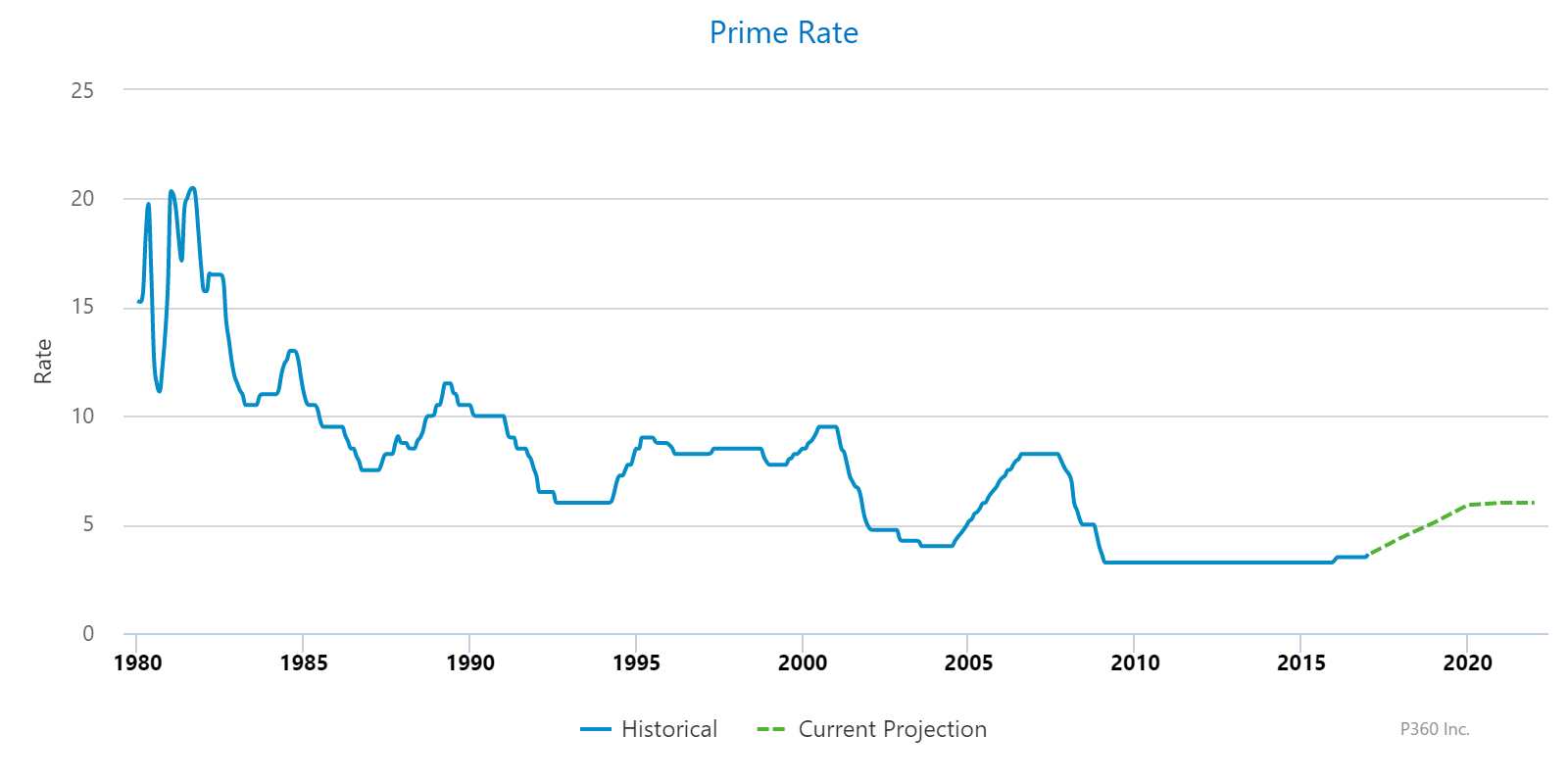

We have experienced interesting market conditions recently including the first Rate Hike in quite a while. Last month’s move by the Federal Reserve was only the second time in a decade that rates have increased, and more are sure to follow More Rate Hikes for 2017.

As economic metrics such as Interest Rates change, it is important to monitor and use the most recent information when running Expected Loss and other risk measures on your loan portfolio. Just like having access to loan level information such as Current Balance, Payment Date, refreshed Credit Scores and updated Property Values, we need to think of Economic Scenarios and other External Inputs as basic data points to include in loan risk modeling.

Keeping up with all the information available can be a daunting task but there are tools and resources available with real-time access. The Federal Reserve makes available historic rates and forecasts for many instruments on their website, including the Effective Federal Funds Rate (EFFR) Federal Reserve. Credit Unions and other portfolio lenders can leverage these information sources, and may not need to recreate the wheel and invest in large projects or additional staff in order to embrace the mountain of information available to help identify loan risk.