Risk & CECL

CECL Solution utilized by clients

vetted by regulators and national accounting firms

CECL Expectations

- Develop an Expected Loss Model

- Consider the Uniqueness of institution

- Utilize External inputs & factors

P360 solves CECL with Mosaic

Institutions are expected to Create and Maintain an Expected Loss model with forward-looking cash flow analysis. Mosaic manages, stores and accesses historic loan data, borrower data and economic data required for modeling.

Not every credit union is the same. CECL models must consider unique attributes such as performance characteristics, membership base, and geo specific data points and include economic inputs, such as GDP, Unemployment, MSA and sub market data over multiple years.

Mosaic manages CECL requirements and provides multiple economic scenarios so that lenders have sufficient data to model their own estimated losses.

CECL Expected Loss

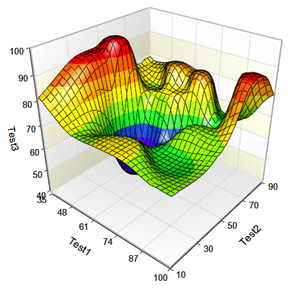

The Mosaic forward-looking CECL Solution involves a multi-faceted process. The process estimates conditional monthly probabilities of default using a regression analysis on several variables of historical data. The variables include loan-level information such as interest rates, borrower-level information such as FICO score, collateral-level information such as the loan-to-value ratio, institution-level information such as whether or not the credit union is employment based, micro-economic data such as the local unemployment rate in the borrower’s metropolitan statistical area (MSA), and macro-economic information such as interest rates.

This CECL Solution takes into account different asset class and loan profiles. Some of the specific segments include:

- Residential

- Commercial

- Consumer