Loan Risk Reporting and Expected Loss

Mosaic utilizes a forward-looking expected loss model to provide

transparency and insight for risk management, due diligence, and CECL preparation

Dive into your portfolio with Mosaic

Make proactive decisions. Focus on growth. Increase earning potential.

What do we do?

Loan & Board Reporting

Reporting and analytics for loan portfolio, production, and surveillance. Mosaic stores and maintains historic risk-runs providing the ability to trends risk and performance attributes.

CECL

Mosaic covers CECL requirements with multiple economic scenarios, unique institutional factors and external inputs to provide expected loss at the loan level.

Expected Loss

Forward-looking process using a regression analysis on several variables at the loan-level, borrower-level, collateral-level, institution-level, and micro & macro economic information.

Portfolio Analysis

Loan level risk grading, Probability of Default, Loss Severity, and risk reporting. Mosaic stores and maintains historic risk-runs, every credit union has the ability to trends risk and performance attributes.

Collateral Values

Track and monitor collateral values for real estate, vehicle, and other collateral based loans. Refreshed values are provided using P360's real estate indexing and collateral depreciation schedules.

Lending Optimization

Identify lending opportunities and "what-if" scenario risk based pricing provide tools to make proactive decisions to focus on growth and profitability.

Drive ahead of the curve with loan-level Expected Loss

Transform your data into useful information. Gain actionable intelligence.

-

Trending & Migrations

In addition to reporting and risk, Mosaic is a data repository that stores your loan data over time for powerful reporting.

-

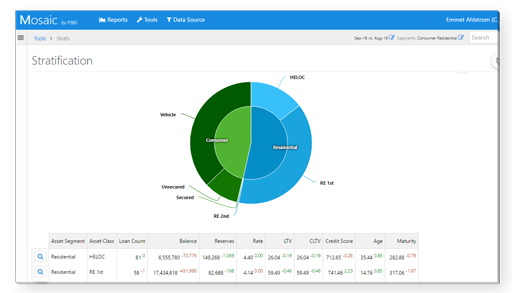

Portfolio Monitoring

Monitor your portfolio, identify concentration risk, stay on top of collateral values, and perform multi-dimensional portfolio analysis.

-

Report on what matters to you

Identify production characteristics by different focuses including branch and loan officer production.

-

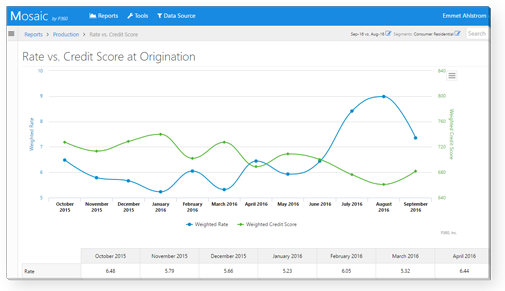

Monitor Rate and Risk

Monitor production to stay on top of your lending and profitability goals. Find out how your production is shaping your loan portfolio.

-

CECL Modeling

Mosaic manages CECL requirements and provides multiple economic scenarios so that lenders have sufficient data to model their own estimated losses.

-

Loan Level Risk

Including Risk Grades, Probability of Default, Loss Severity, Expected Loss (ALLL), and risk reporting.