Due Diligence

Mosaic Integrity is more than just Due Diligence

Due Diligence and Loan Risk

The team at P360 has been in the forefront of technology providing loan risk analytics and underwriting for more than 2 decades.

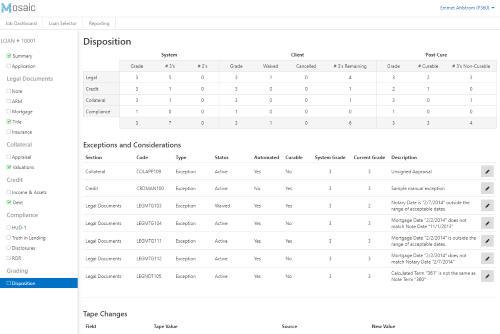

Today, Mosaic Integrity connects the process of due diligence with actionable reporting for residential, consumer and commercial assets by coupling data verification with loan performance metrics. Investors gain insight to better anticipate cash flow with P360’s expected loss model and loan score.

Mosaic connects all parties in real time providing transparency to loan level detail and performance risk during every phase empowering investors and portfolio managers to make better decisions, sooner.

Services & Solutions

- Whole Loan Trading – Residential, Consumer and Commercial

- Regulatory Compliance Review

- Credit Underwrite

- Servicing Collateral Audit, Legal Review, HMDA

- Quality Control, Data Integrity

- Property Value Analysis

- Securitization and Tranche Analysis

- M&A – Commercial, Consumer and Residential

Asset Intelligence

- Residential, Consumer, Commercial

- Seasoned, Sub-Performing

- Non QM

- Pre & Post Funding, Warehouse Lines

- Servicing Valuation, Payment History

- Conforming, Non-Conforming

Mosaic helps Originators, Investors, and Securitizers track each asset from a marketing campaign thru origination to the secondary market and monitor loan performance.

The P360 team has managed over 3,800 transactions ranging from loan audit, M&A, portfolio review, compliance and collateral audits.